Understanding Your Residential Roof Insurance Claim

When you receive an insurance claim for your roof, it can be confusing to figure out how much you actually owe versus how much the insurance company is paying. Most claim summaries are written from the insurance company’s perspective, not yours.

At Bunton Roofing Company, we help Abilene and Big Country homeowners understand their insurance paperwork, what each line means, and how to calculate their balance.

Common Insurance Terms

Deductible

The out-of-pocket amount you’re responsible for before insurance pays—usually 1-3% of the property’s insured value.

ACV (Actual Cash Value)

The depreciated value of your roof.

Depreciation

The loss in value of your roof due to age or wear. Roofs over 10 years old may move to a higher deductible.

Recoverable Depreciation

The portion of depreciation you can recover after work is complete (RCV policies only).

RCV (Replacement Cost Value)

The total cost to replace your roof at today’s prices.

Mortgage Endorsement

When your mortgage company must sign off on your insurance checks before you can deposit them.

RCV vs. ACV Policies

Replacement Cost Value (RCV) Policy

Covers the full cost to replace your roof.

You’ll receive two checks from your insurer:

First check for the depreciated amount (ACV).

Second check for the recoverable depreciation after the work is finished.

You must pay your deductible to Bunton Roofing and often show proof of payment.

Your mortgage company may need to endorse the checks before you can deposit them.

Actual Cash Value (ACV) Policy

Covers only your roof’s current value after depreciation.

You’ll receive one check for that amount.

You pay your deductible and any remaining balance out of pocket.

There is no recoverable depreciation payment.

How to Read Your Insurance Claim

Every insurance claim will show three main numbers:

Replacement Cost Value (RCV): what your roof costs to replace at today’s prices.

Depreciation: the amount your insurance company subtracts because your roof has aged. Your will owe this amount.

Net Actual Cash Value (ACV) Payment: what the insurance initially pays out.

To find what you owe, use this simple formula:

RCV – Net ACV Payment = Your Remaining Balance

Example:

RCV: $15,000

Net ACV Payment: $5,000

You Owe: $10,000

This includes your deductible and any depreciation your policy doesn’t cover.

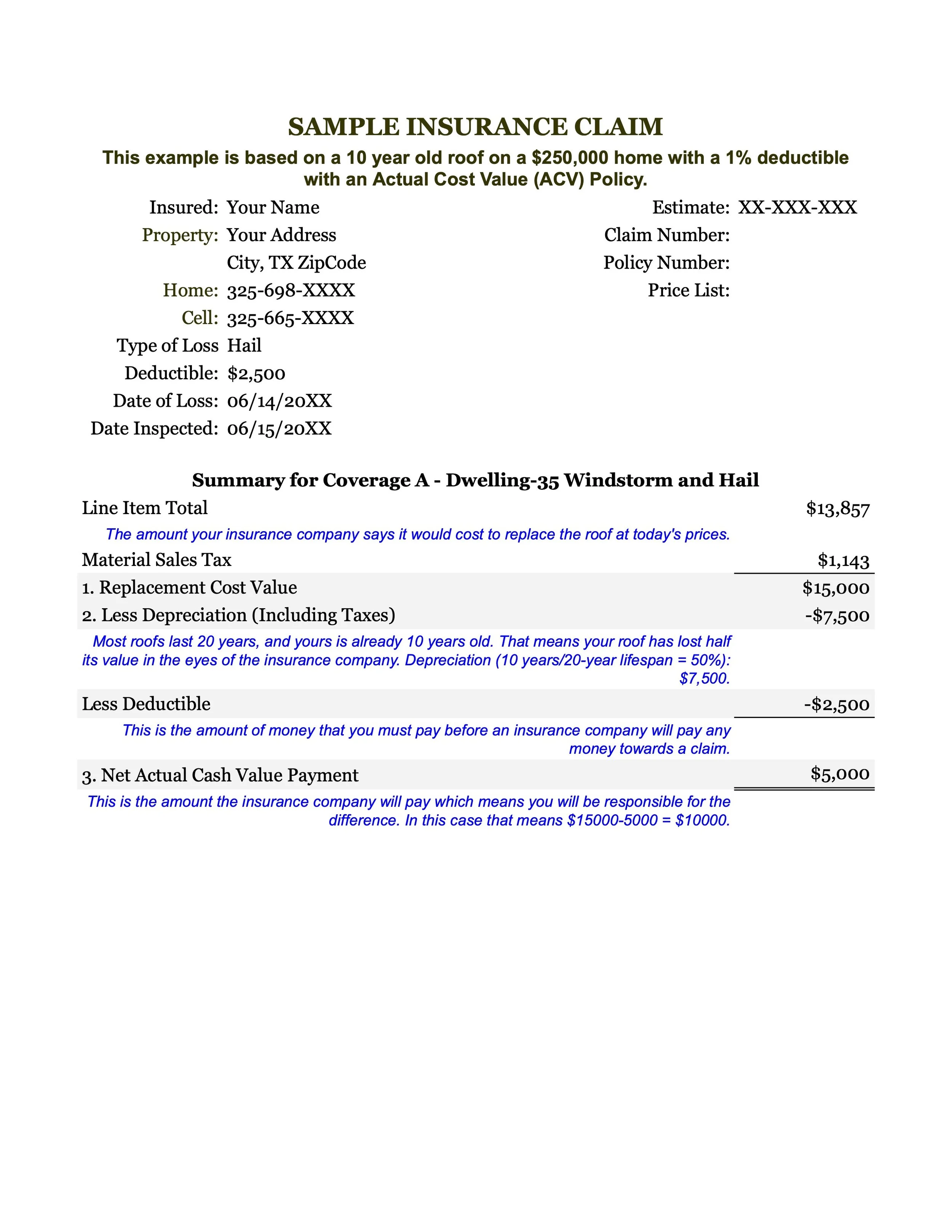

Example Insurance Claim Explained

Below is an example from a real-world insurance estimate for a hail-damaged roof. We’ve broken it down into sections to help you understand what each number means.

Replacement Cost Value (RCV) – $15,000

This is the total estimated cost to replace your roof at today’s prices, including materials, labor, and sales tax.

Depreciation – ($7,500)

Because this roof was 10 years old with a 20-year lifespan, the insurance company depreciated it by 50%.

This amount is withheld until the work is completed—if your policy is RCV, you’ll later receive this back as recoverable depreciation. If your policy is ACV, you will be responsible for this amount.Deductible – ($2,500)

Texas law requires that you pay your deductible out of pocket before insurance funds are released. It cannot be waived or “covered” by a contractor.

Net Actual Cash Value (ACV) Payment – $5,000

This is your first insurance check—the amount your insurance company pays initially to begin the work. You’ll typically receive this check made out to you and your mortgage company.

Recoverable Depreciation (RCV policies only)

Once the roof is completed and your contractor provides proof of completion and deductible payment, the insurance company issues a second check for the withheld depreciation. This restores you to the full replacement cost.

Financing Options Available

If your deductible or uncovered costs are difficult to manage, Bunton Roofing offers financing through First Financial Bank.

We’ll help you explore flexible options to make your roof replacement affordable.

FAQs

-

Yes. Texas law (Texas Insurance Code § 707.002) requires that you pay your deductible. It’s illegal for a contractor to waive it.

-

No. The first check (ACV payment) is meant to start the job. Your deductible must be paid separately.

-

Most lenders require this to ensure the funds are used for repairs. You’ll need to send the checks to your mortgage company for endorsement.

-

Absolutely. It’s safe—and smart—to share your insurance paperwork with a trusted Abilene roofing company like Bunton Roofing. We use it to make sure our scope of work matches your insurance estimate.

-

No. Insurance is designed to make you whole after a loss, not to profit. You’re still responsible for your deductible and any uncovered costs.

We’re Here to Help

Bunton Roofing Company has years of experience helping homeowners across Abilene, Sweetwater, Albany, Stamford, Clyde, Tuscola, and the Big Country navigate the insurance claim process. We’ll explain your paperwork, communicate with your adjuster if needed, and make sure your roof is restored with honesty and care.

Call today for help understanding your roof claim or to schedule a free inspection.

325-274-7050.